Explain Difference Between Cash Flow and Fund Flow Statement

It is prepared on the basis of fund as working capital. Rated the 1 Accounting Solution.

Let S Understand The Difference Between Cash Flow And Fund Flow Statement

A cash flow statement is a valuable measure of strength profitability and the long-term future outlook of a company.

. Cash flow statement is a statement which reflects sources and uses of cash. Funds flow statements report changes in a. The cash flow statement is different.

The cash flow statement is one of the four financial statements that every investor looks at to understand the financial position of a company. Fund flow is based on the concept of changes. The funds flow statement definition is a statement that explains the working capital change in a company.

A cash basis of accounting is used to generate the cash flow statement. Inflows and outflows of cash and cash equivalents. One of the meanings of fund is cash and.

Elements of the Cash Flow Statement. Ad QuickBooks Financial Software. Funds from operation is.

Cash flow refers to the concept of inflow and outflow of cash and cash equivalents during a particular period. Cash flow is based on the concept of outflow and inflow of cash and cash equivalents during a particular period. The fund flow statement on the other hand.

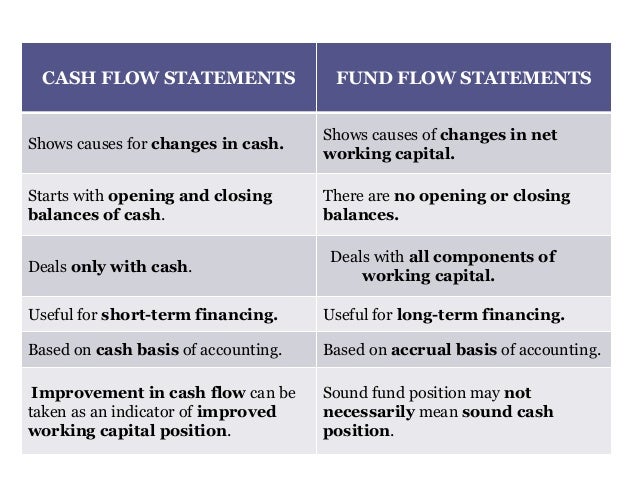

Cash flow statements signify the changes in the cash and cash equivalents of the business due to the business operations in one time period. The term Fund has acquired number of meanings depending on the broadness or narrowness of the context in which it is used. The major differences between cash flow statement and fund flow statement are as follows.

8 rows Key Differences Between Cash Flow Statement and Flow Flow Statement. There are some basic differences between the two statements as mentioned below. 13 rows It is prepared on the basis of cash and cash equivalents.

Accounting for cash flow is done only when liquid cash is involved in the form of currency or bank transfer. Cash flow from operating activities. The CFS can help determine whether a company has.

Cash is part of. Cash from operation is calculated. Cash flow refers to all cash which is flowing in and out of the business while fund flows.

Fund flow refers to the concept of financial changes in working. A fund flow statement is a statement prepared to analyse the reasons for changes in the financial position of a company between two balance sheets. The cash flow statement is best suited to gauge a companys liquidity profile whereas the fund flow statement is best geared towards long-term financial planning.

Difference between Funds Flow Statement Cash Flow Statement. Fund flow is accounted on the basis of accrual of funds and not actual payment or. It is an analytical statement of the changes presenting its financial position between.

It portrays the inflow and. The cash flow statement. Rated the 1 Accounting Solution.

A companys balance sheet and income statement measures one aspect of performance of the business over a period of time. Cash flow from financing activities. The fund flow statement on the other hand is generated using the accrual accounting method.

Cash flow from investing activities. Both Funds flow statement and Cash Flow Statement are used in analysis of part transactions of a business firm. Ad QuickBooks Financial Software.

A cash flow statement is concerned only with the change in cash position while a fund flow analysisstatement is concerned the change in working capital position.

Cash Flow Vs Fund Flow Differences Structure Efm

Fund Flow Statement Lessons Blendspace

The Difference Between Cash Flow And Fund Flow Differbetween

No comments for "Explain Difference Between Cash Flow and Fund Flow Statement"

Post a Comment